Introduction to What is a Journal Entry in Accounting

In this article we will go through the article What is a Journal Entry in Accounting

What is a Journal

A detailed account that records all the financial transactions of a business, to be used for the future reconciling of accounts and the transfer of information to other official accounting records, such as the general ledger.

purpose of a journal in accounting

The purpose of a journal in accounting is to provide a detailed and chronological record of all financial transactions.

Here are the key reasons why a journal is important

1. Record Keeping

The journal serves as the primary place where every financial transaction is first recorded. It captures the date, accounts involved, amounts, and a brief description of each transaction.

2. Organization

Journals help organize transactions by recording them in the order they occur. This chronological order makes it easier to trace and review past transactions.

3. Accuracy

By systematically recording transactions, the journal helps ensure that the financial records are accurate. Each transaction is recorded with a corresponding debit and credit, maintaining the balance in the accounting equation (Assets = Liabilities + Equity).

4. Audit Trail

Journals provide a clear trail for auditors or accountants to follow, making it easier to verify and trace back any transaction. This is crucial for ensuring transparency and compliance with accounting standards.

5. Preparation of Financial Statements

The information in the journal is used to update the general ledger, which is then used to prepare financial statements like the balance sheet and income statement. Without a properly maintained journal, these statements could be incomplete or inaccurate.

6. Error Detection

Journals help in detecting errors early in the accounting process. If the debits and credits don’t match, it signals that there might be a mistake that needs correction.

Read also : Golden Rules of Accounting

What is a Journal Entry in Accounting

We will discuss the items of the format in Journal Entry one by one

1. Date

What it is: The date refers to the specific day when the transaction took place.

Why it matters: Recording the date ensures that transactions are entered in the correct order. This chronological arrangement is crucial for tracking the financial history of a business and for preparing accurate financial statements.

How it’s recorded: The date is usually written as “Year, Month, Day” (e.g., 2024 August 14).

2. Particulars

What it is: The “Particulars” column is where you describe the accounts involved in the transaction.

Why it matters: This section tells you which accounts are affected by the transaction—one account is debited, and another is credited. It’s essential for understanding the impact of the transaction on the business’s financial position.

How it’s recorded

Debited Account: The account that receives value or benefit is listed first, followed by the abbreviation “Dr.” (for Debit).

Credited Account: The account that gives value is listed second, prefixed by “To” and followed by the account name. This account is indented to show it is credited.

Narration: Underneath the credited account, you add a brief explanation or description of the transaction. This is called the narration, and it provides context for the entry, making it easier to understand why the transaction occurred.

3. Ledger Folio (L.F.)

What it is: The Ledger Folio (L.F.) is a reference number or code that links the journal entry to the specific page or account in the general ledger where this transaction is posted.

Why it matters: This helps in cross-referencing and ensures that you can easily trace back the transaction to the general ledger for further details. It’s a crucial tool for accountants during audits or reviews.

How it’s recorded: The L.F. column is typically filled with a number or code that matches the entry in the general ledger.

4. Amount (Dr.)

What it is: This column shows the amount of money that is being debited in the transaction.

Why it matters: The debit amount represents an increase in assets or expenses or a decrease in liabilities, equity, or income. Recording the correct amount here is essential for maintaining the balance in the accounting system.

How it’s recorded: The amount is listed in the “Dr.” column, aligned with the debited account.

5. Amount (Cr.)

What it is: This column shows the amount of money that is being credited in the transaction.

Why it matters: The credit amount represents an increase in liabilities, equity, or income, or a decrease in assets or expenses. Just like the debit side, recording the correct amount here ensures that the books are balanced.

How it’s recorded: The amount is listed in the “Cr.” column, aligned with the credited account.

Some of the Examples

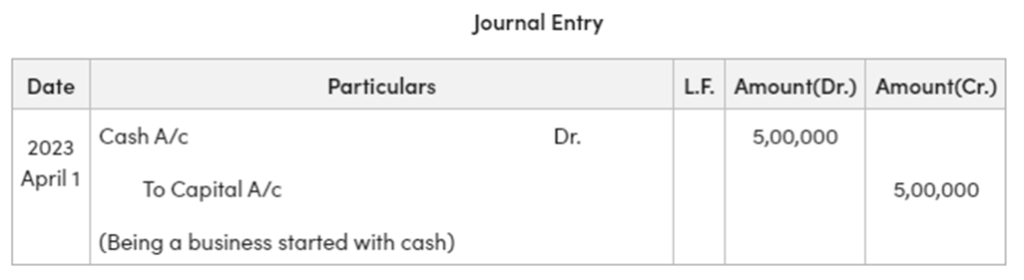

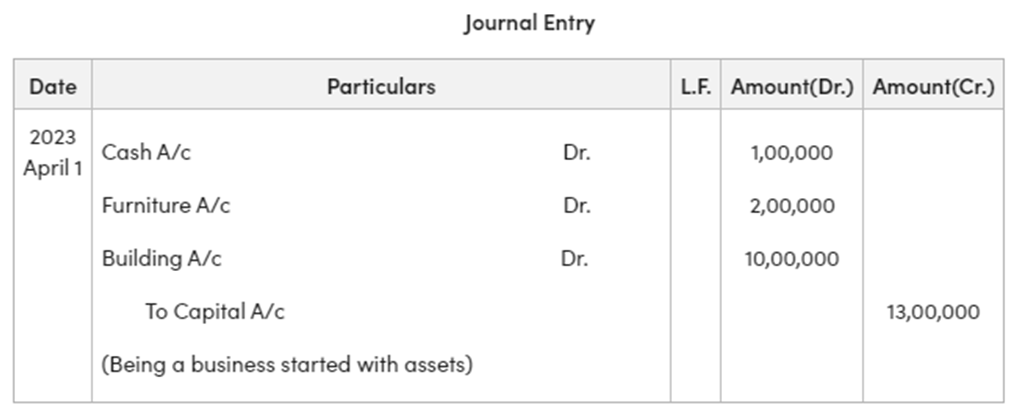

Pass the necessary journal entries related to the ‘Opening Entry’.

(a) On 1st April 2023, Ram started a business with cash ₹5,00,000.

(b) On 1st April 2023, Vinod started business with cash ₹1,00,000, furniture ₹2,00,000, and Building ₹10,00,000.

Example

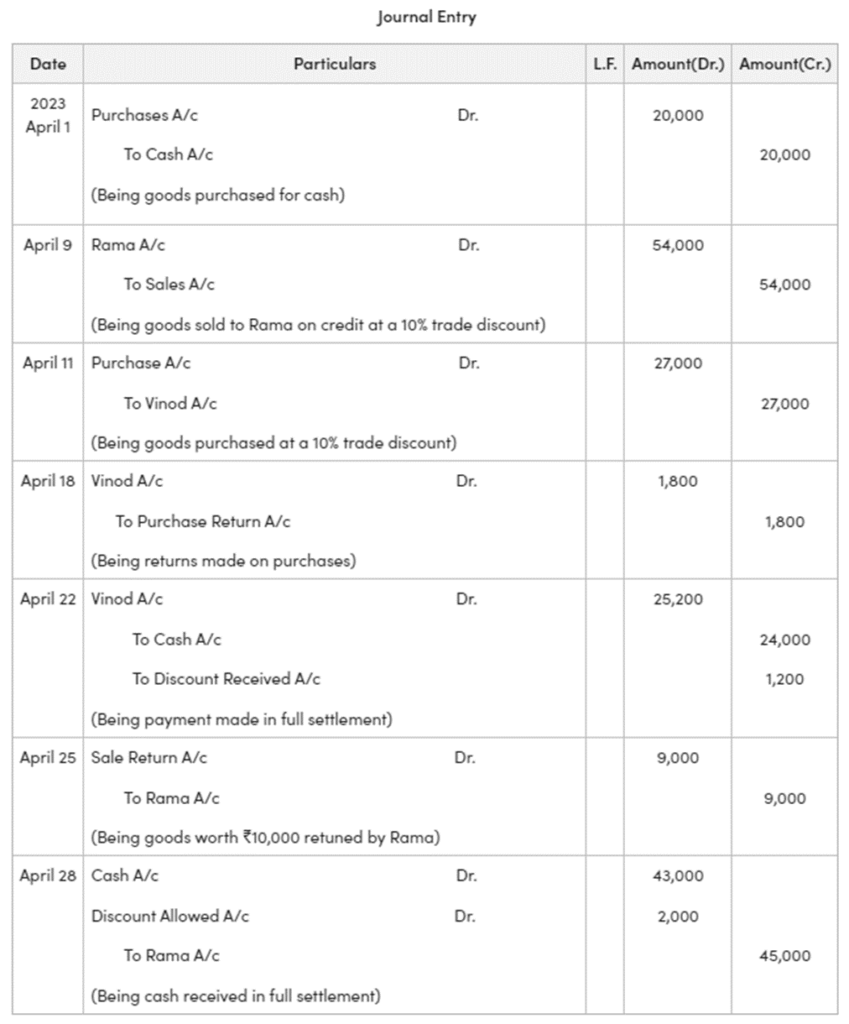

Pass the necessary journal entries in the books of Reshi Raj,

(a) On 1 April 2023, Cash Purchases ₹20,000.

(b) On 9 April 2023, Sold goods to Rama at the list price of ₹60,000 at a trade discount of 10%.

(c) On 11 April 2023, Vinod sold goods to us worth ₹30,000 at a 10% trade discount.

(d) On 18 April 2023, Returned goods to Vinod at the list price of ₹2,000.

(e) On 22 April 2023, Paid cash to Vinod ₹24,000 in full settlement.

(f) On 25 April 2023, Rama returned goods of list price ₹10,000.

(g) On 28 April 2023, Rama paid ₹43,000 in full settlement of his account.

Solution

Vitazen Keto Gummies I like the efforts you have put in this, regards for all the great content.

Wonderful beat I wish to apprentice while you amend your web site how could i subscribe for a blog web site The account aided me a acceptable deal I had been a little bit acquainted of this your broadcast provided bright clear idea

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Pretty! This has been a really wonderful post. Many thanks for providing these details.

Techno rozen I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Nice post. I learn something totally new and challenging on websites

This was beautiful Admin. Thank you for your reflections.

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

Pink Withney You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

Hi my family member I want to say that this post is awesome nice written and come with approximately all significant infos I would like to peer extra posts like this

I’m really enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a developer to create your theme? Exceptional work!

Good day! This post couldn’t be written any better! Reading this post reminds me of my old room mate! He always kept chatting about this. I will forward this write-up to him. Pretty sure he will have a good read. Many thanks for sharing!

Perfectly indited articles, Really enjoyed looking at.

I appreciate how you tackle difficult topics.

Wow! This can be one particular of the most useful blogs We have ever arrive across on this subject. Basically Fantastic. I am also a specialist in this topic therefore I can understand your effort.