Introduction to Accounting: Introduction Objectives and Types

In this article we will go through the topic Accounting: Introduction, Objectives and Types

Introduction to Accounting

Accounting is often referred to as the language of business because it is a systematic process of identifying, recording, measuring, classifying, verifying, summarizing, interpreting, and communicating financial information. Its primary purpose is to provide financial information about a business entity to various stakeholders for decision-making purposes.

Definitions to Accounting

1. Accounting is the systematic process of recording, summarizing, and reporting financial transactions of a business. It helps in tracking income and expenses, ensuring accuracy and providing essential information for making informed financial decisions.

2. Accounting is the method of maintaining financial records to track a company’s financial activities. It involves documenting all money coming in and going out, preparing financial statements, and ensuring compliance with relevant laws and regulations.

Objectives of Accounting

1. Record Transactions

Recording transactions is a fundamental objective of accounting. This involves documenting every financial transaction that occurs within a business in a systematic and consistent manner. Each transaction is recorded in the appropriate journal (e.g., sales journal, purchase journal) with details such as date, amount, accounts affected, and a brief description. Accurate recording ensures that all financial activities are captured, providing a complete historical record for reference and analysis.

2. Maintain Financial Records

Maintaining financial records is crucial for ensuring the accuracy and completeness of a business’s financial data. This includes keeping track of all financial documents, such as invoices, receipts, bank statements, and contracts. Proper record maintenance supports the integrity of financial reporting, facilitates audits, and helps in reconciling discrepancies. It ensures that all financial information is readily available and organized, making it easier to manage and retrieve data when needed.

3. Prepare Financial Statements

One of the primary goals of accounting is to prepare financial statements that summarize the financial performance and position of a business.

The key financial statements include

Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Income Statement: Shows the company’s revenues, expenses, and profits over a period.

Cash Flow Statement: Details the cash inflows and outflows from operating, investing, and financing activities over a period.

These statements are essential for internal and external stakeholders to assess the financial health and performance of the business.

4. Aid Decision-Making

Accounting provides valuable insights and data that help business owners and managers make informed decisions. By analyzing financial reports and statements, management can identify trends, evaluate performance, and make strategic decisions regarding investments, cost control, pricing, and expansion. Accurate financial information enables effective planning, budgeting, and forecasting, which are critical for achieving business objectives and maintaining competitiveness.

5. Ensure Legal Compliance

Adhering to relevant laws, regulations, and accounting standards is a vital objective of accounting. Businesses must comply with various regulatory requirements, such as tax laws, financial reporting standards (e.g., GAAP, IFRS), and industry-specific regulations. Ensuring legal compliance involves accurate and timely filing of tax returns, adhering to accounting principles, and maintaining transparency in financial reporting. Compliance helps in avoiding legal penalties, maintaining the business’s reputation, and building trust with stakeholders.

Conclusion to Objectives of Accounting

The key objectives of accounting revolve around the systematic documentation and maintenance of financial transactions, preparation of critical financial statements, aiding in decision-making processes, and ensuring adherence to legal and regulatory standards. These objectives collectively contribute to the accurate and reliable financial management of a business, enabling informed decision-making and sustained growth.

Accounting: Introduction Objectives and Types

Read Also : Definition and Importance Of Economics

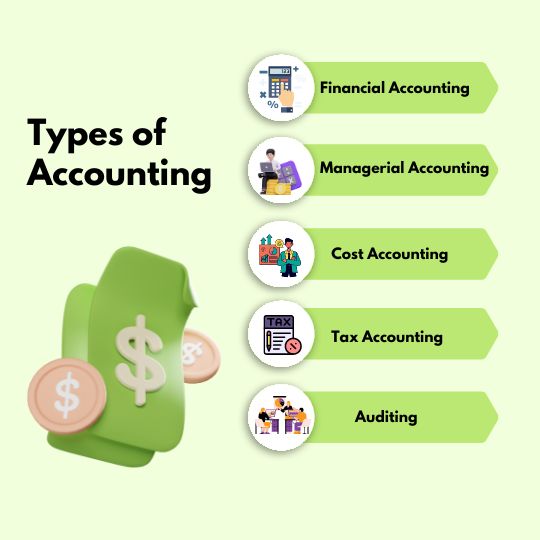

Types of Accounting

1. Financial Accounting

Financial accounting is primarily concerned with the preparation of financial statements aimed at external stakeholders, such as investors, creditors, regulators, and the public. The primary goal is to provide a clear and accurate picture of the company’s financial performance and position.

Key financial statements produced include

a. Balance Sheet The Balance Sheet provides a snapshot of a company’s financial health at a specific point in time. It lists the company’s assets, liabilities, and equity.

Assets: What the company owns, such as cash, inventory, and property.

Liabilities: What the company owes, including loans and accounts payable.

Equity: The net worth of the company, calculated as assets minus liabilities. This represents the owners’ stake in the company.

b. Income Statement

The Income Statement, also known as the Profit and Loss Statement, shows the company’s financial performance over a particular period, typically a quarter or a year. It details revenues and expenses to indicate whether the company made a profit or incurred a loss.

Revenues: The total income generated from sales of goods or services.

Expenses: The costs incurred in earning those revenues, such as cost of goods sold, salaries, and rent.

Net Profit or Loss: The difference between total revenues and total expenses. A positive number indicates profit, while a negative number indicates loss.

Cash Flow Statement

The Cash Flow Statement tracks the flow of cash in and out of the business over a specified period.

It is divided into three main sections

Operating Activities: Cash flows from the core business operations, such as receipts from sales and payments to suppliers and employees.

Investing Activities: Cash flows related to the purchase and sale of long-term assets like property and equipment.

Financing Activities: Cash flows from transactions with the company’s owners and creditors, including issuing shares, borrowing, and repaying debt.

These statements are prepared following standardized guidelines like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to ensure consistency and comparability.

2. Managerial Accounting

Managerial accounting provides detailed financial and non-financial information to internal management for planning, decision-making, and control purposes. Unlike financial accounting, managerial accounting is not bound by standardized formats or principles, allowing for more flexibility to meet the specific needs of management.

Key activities in managerial accounting include

Budgeting

Creating detailed financial plans for the future.

Performance Evaluation

Analyzing the efficiency and effectiveness of different business segments.

Cost Analysis

Assessing the costs of different activities and processes to enhance cost control.

Decision Support

Providing data and insights to support strategic decisions, such as pricing, investment, and production planning.

3. Cost Accounting

Cost accounting focuses on capturing and analyzing the costs associated with producing goods or providing services. It helps management in understanding cost behavior, controlling costs, and improving profitability.

Key aspects of cost accounting include

Cost Identification

Determining all the costs involved in the production process, including direct materials, direct labor, and overheads.

Cost Allocation

Assigning costs to specific products, departments, or projects to understand their true cost structure.

Cost Control

Monitoring and managing costs to keep them within budgeted levels.

Cost Reduction

Identifying areas where costs can be reduced without compromising quality or efficiency.

4. Tax Accounting

Tax accounting focuses on matters related to taxation, ensuring compliance with tax laws and regulations. It involves preparing tax returns, tax planning, and managing tax liabilities.

The main objectives of tax accounting include

Tax Compliance

Ensuring that all tax filings are accurate and submitted on time according to local, state, and federal tax laws.

Tax Planning

Strategically planning financial activities to minimize tax liabilities within the legal framework.

Tax Record Keeping

Maintaining detailed records of income, expenses, and other tax-related transactions to support tax filings and audits.

5. Auditing

Auditing involves the independent examination and verification of financial statements and other financial records to ensure their accuracy and compliance with applicable standards and regulations. Auditors provide an objective assessment of the financial health and integrity of a business.

There are two main types of auditing

Internal Auditing

Conducted by an organization’s internal audit team to evaluate internal controls, risk management, and governance processes.

External Auditing

Performed by independent auditors to provide an unbiased opinion on the accuracy and fairness of the financial statements.

Auditing enhances the credibility of financial statements, helps detect and prevent fraud, and ensures adherence to accounting standards and regulations.

Conclusion to Types of Accounting

The various types of accounting serve different purposes and cater to different stakeholders. Financial accounting provides essential information to external parties through standardized financial statements. Managerial accounting supports internal management with flexible and detailed reports for decision-making and control. Cost accounting focuses on understanding and managing production costs.

Tax accounting ensures compliance with tax laws and efficient tax management. Auditing provides assurance on the accuracy and reliability of financial information, enhancing trust and transparency. Together, these accounting disciplines contribute to the overall financial health and management of an organization.

Accounting: Introduction Objectives and Types

Importance of Accounting

Accounting plays a crucial role in the functioning and success of businesses, organizations, and economies. Its importance extends across various dimensions, including financial management, legal compliance, strategic decision-making, and stakeholder communication.

Here’s an in-depth look at why accounting is indispensable

1. Financial Management

Accounting provides a structured and systematic approach to recording and managing financial transactions. By keeping accurate and up-to-date records, businesses can

Track Income and Expenses

Regularly monitor where money is coming from and where it is going, helping in budgeting and financial planning.

Control Costs

Identify and manage costs effectively, reducing wastage and improving efficiency.

Ensure Liquidity

Maintain adequate cash flow to meet day-to-day operational needs and avoid insolvency.

2. Legal Compliance

Accounting ensures that businesses comply with various legal and regulatory requirements.

This includes

Tax Compliance

Preparing accurate tax returns and ensuring timely payment of taxes, thus avoiding legal penalties and interest charges.

Regulatory Reporting

Adhering to financial reporting standards (like GAAP or IFRS) and industry-specific regulations, ensuring transparency and accountability.

Audit Preparedness

Maintaining thorough and organized financial records that facilitate smooth and efficient audits by internal or external auditors.

3. Decision-Making

Accurate accounting information is essential for making informed business decisions.

It helps management and stakeholders to

Evaluate Performance

Analyze financial statements to assess profitability, liquidity, and overall financial health.

Strategize and Plan

Develop strategic plans based on financial trends and forecasts, setting realistic goals and objectives.

Investment Decisions

Make informed decisions about investments, expansion, and resource allocation by evaluating financial viability and potential returns.

4. Stakeholder Communication

Accounting serves as a critical communication tool between a business and its stakeholders, including investors, creditors, employees, and regulators.

Through financial statements and reports, accounting provides

Transparency

Offering clear and accurate financial information that builds trust and confidence among stakeholders.

Accountability

Demonstrating that the business is managed responsibly and ethically, with financial resources being used effectively.

Investor Relations

Providing investors with the necessary information to make informed decisions about buying, holding, or selling their stakes in the business.

5. Financial Planning and Forecasting

Accounting information is vital for future planning and forecasting.

By analyzing historical financial data, businesses can

Predict Trends

Identify and predict financial trends and patterns that help in setting future goals.

Budgeting

Create detailed budgets that align with business objectives and monitor performance against those budgets.

Your blog has quickly become my go-to source for reliable information and thought-provoking commentary. I’m constantly recommending it to friends and colleagues. Keep up the excellent work!

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do it Your writing style has been amazed me Thank you very nice article

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

Wow wonderful blog layout How long have you been blogging for you make blogging look easy The overall look of your site is great as well as the content

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers

I do not even know how I ended up here but I thought this post was great I do not know who you are but certainly youre going to a famous blogger if you are not already Cheers

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers

Pretty! This has been a really wonderful post. Many thanks for providing these details.

I am not sure where youre getting your info but good topic I needs to spend some time learning much more or understanding more Thanks for magnificent info I was looking for this information for my mission

Noodlemagazine I appreciate you sharing this blog post. Thanks Again. Cool.

Wow wonderful blog layout How long have you been blogging for you make blogging look easy The overall look of your site is great as well as the content