Introduction to Arranging Funds for a Business or a Project

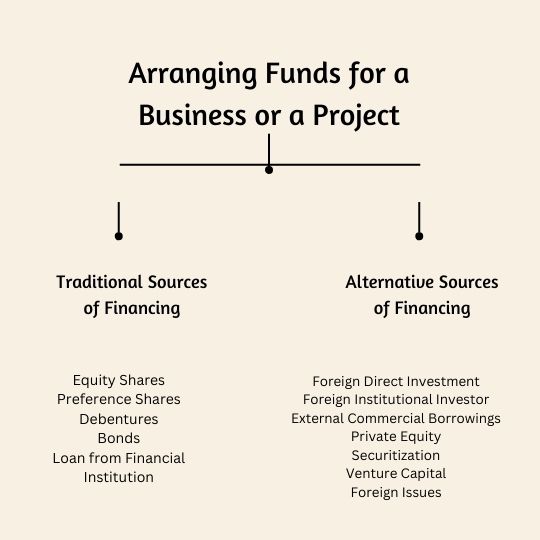

In this article we will go through the topic Arranging Funds for a Business or a Project. Arranging funds for a business or project is essential for its growth and sustainability. A project or business can secure funds from various sources through strategic financial planning and networking. Traditional sources of financing include equity shares, preference shares, debentures/bonds, and loans from financial institutions.

Alternative sources of financing provide businesses with a diverse set of options beyond traditional methods like Foreign Issues, Foreign Direct Investment (FDI), Foreign Institutional Investment (FII), External Commercial Borrowings (ECB), Private Equity, Securitization, Venture Capital etc.

Arranging Funds for a Business or a Project

Traditional Sources of Financing

1. Equity Shares

Equity shares represent ownership in a company and are the most common form of equity financing. The process involves selling ownership stakes to shareholders in exchange for capital. It doesn’t involve repayment of the invested capital, but shareholders receive a share of profits in the form of dividends. This source of financing is ideal for raising capital when the business is starting or expanding and is willing to share ownership and profits with investors.

2. Preference Shares

Preference shares are a hybrid financing option, combining elements of equity and debt. They offer a fixed dividend to shareholders and priority in receiving dividends over common equity shareholders. Preference shareholders typically don’t have voting rights and don’t participate in the company’s management. This source of financing is suitable when the company wants to secure funding without diluting control or facing immediate repayment obligations.

3. Debentures/Bonds

Debentures and bonds are forms of long-term debt financing. Debentures are typically unsecured, while bonds are secured by specific assets or collateral. Investors purchase debentures or bonds and receive periodic interest payments (coupon) and the principal amount at maturity. This source of financing is useful for businesses that require substantial long-term capital and are comfortable with servicing regular interest payments.

4. Loans from Financial Institutions

Loans from financial institutions, such as banks or credit unions, provide businesses with access to funds in exchange for periodic interest payments and repayment of the principal. Loans can be short-term (working capital loans) or long-term (term loans) and may be secured or unsecured. These loans are ideal for businesses that need working capital, expansion capital, or project-specific funding and can meet the lender’s credit requirements.

Arranging funds using traditional sources involves a combination of these financing options, depending on the business’s needs and financial structure. It’s important to carefully consider the advantages,disadvantages, and costs associated with each source and tailor the financing arrangement to match the business’s specific goals and financial circumstances.

Arranging Funds for a Business or a Project

Read Also : Social Cost Benefit Analysis

Alternative sources of financing

Alternative sources of financing provide businesses with a diverse set of options beyond traditional methods.

Alternative sources can include

1. Foreign Issues

Foreign issues involve raising capital by issuing securities, such as stocks or bonds, in international markets. Companies may issue American Depositary Receipts (ADRs) in the U.S. or Global Depositary Receipts (GDRs) in international markets to attract foreign investors.

2. Foreign Direct Investment (FDI)

FDI occurs when a foreign entity invests directly in a company or establishes a subsidiary in another country. FDI provides long-term capital and can involve equity investments or reinvested earnings.

3. Foreign Institutional Investment (FII)

FIIs are institutional investors, like mutual funds or pension funds, that invest in the securities of companies in another country. These funds can bring foreign capital into the country’s financial markets.

4. External Commercial Borrowings (ECB)

ECB refers to loans or debt instruments borrowed from foreign lenders, including international banks and financial institutions. It provides access to foreign currency funds for various purposes, such as expansion or working capital.

5. Private Equity

Private equity funds invest in private companies, often providing capital for growth, acquisitions, or restructuring. Private equity firms take an equity stake in the company and may exit through a sale or public offering.

6. Securitization

Securitization involves converting illiquid assets (e.g., loans, mortgages) into tradable securities.These securities are sold to investors, allowing companies to free up capital for new lending or investments.

7. Venture Capital

Venture capital is funding provided to startups and early-stage companies by venture capital firms. It’s typically in exchange for equity and can help fund research, development, and market expansion.

8. Crowdfunding

Crowdfunding platforms allow businesses to raise small amounts of capital from a large number of individuals. It can be reward-based (e.g., Kickstarter), equity-based, or debt-based crowdfunding.

9. Angel Investors

Angel investors are high-net-worth individuals who provide capital to startups and small businesses. They often offer mentorship and guidance in addition to funding.

10. Trade Credit

Trade credit involves negotiating extended payment terms with suppliers, allowing a business to defer certain expenses. This is a common form of short-term financing.

11. Grants and Subsidies

Governments and organizations offer grants and subsidies for specific projects, research, or industries. These funds do not require repayment and can support innovation and development.

12. Initial Coin Offerings (ICOs) and Token Sales

In the blockchain and cryptocurrency space, companies raise capital by issuing tokens or coins to investors in exchange for cryptocurrency or fiat currency.

13. Leasing and Asset Financing

Companies can lease equipment or assets instead of purchasing them outright, conserving capital while still gaining access to necessary resources.

14. Mezzanine Financing

Mezzanine financing involves a combination of debt and equity, offering a higher risk-reward profile than traditional loans.

Each of these alternative sources of financing comes with its own advantages, disadvantages, and terms. The choice of financing source depends on the business’s specific needs, stage of development, risk tolerance, and ability to meet the requirements of potential investors or lenders.