Introduction to Why the US Dollar Is the Global Currency

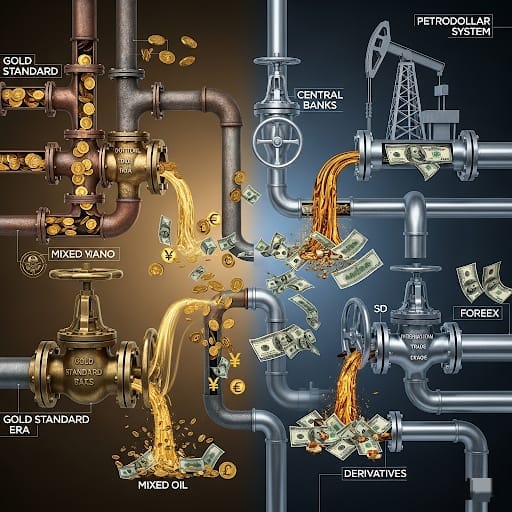

In this article we will go through the topic Why the US Dollar Is the Global Currency. From a national currency to the world’s most trusted medium of exchange, the US Dollar has undergone a remarkable transformation shaped by global conflicts, economic strategy, and institutional influence — a journey that reflects the shifting power dynamics of the modern financial world.

In the complex landscape of global finance, one currency stands out as the backbone of international trade and monetary stability — the United States Dollar (USD). Often referred to as the world’s “reserve currency,” the dollar plays a dominant role not only in cross-border transactions but also in central bank reserves, commodity pricing, debt issuance, and global financial markets.

However, the rise of the US Dollar to this unparalleled position was not merely a product of circumstance — it was the result of calculated strategies, long-term planning, and the ability to shape global economic frameworks in its favour. Through a combination of post-war diplomacy, institutional influence, and the creation of financial systems that encouraged widespread dollar use, the United States laid a foundation that enabled its currency to gain — and maintain — global dominance. This article explores the historical, economic, political, and strategic factors that have cemented the US Dollar as the cornerstone of the international financial system.

Before the rise of modern currencies, human societies relied on the barter system — the direct exchange of goods and services. While this method worked in small, local communities, it quickly became impractical for large-scale or long-distance trade due to the lack of a common standard of value and the difficulty in matching needs. To solve this, ancient civilizations introduced metallic currencies such as gold, silver, and copper coins. These metals held intrinsic value, were durable, and could be standardized for easier exchange, making trade far more efficient.

However, as trade routes expanded and long-distance business travel became more common, carrying large amounts of gold or silver became both risky and impractical. To work around this, a new informal practice began to emerge among traders. A merchant traveling from one city to another would find a trusted trader in his hometown and deposit his gold with him. In return, he would receive a written note — a kind of receipt stamped as proof of the gold deposit. This note would then be presented in the destination city, where the partner of the original trader would arrange to provide the equivalent amount of gold.

While this system reduced the need to physically carry precious metals, it operated purely on trust and lacked standardization. The entire process was informal, unregulated, and vulnerable to fraud or disputes. These weaknesses highlighted the need for a more organized and secure financial system — one that could support growing trade and economic expansion with greater reliability and transparency.

The Birth of Paper Money

A Revolutionary Shift from Ancient China

A major turning point in the history of money and trade occurred in the 12th century, when a groundbreaking innovation emerged in China — the concept of paper currency. In the year 1154, Wanyan Liang, the fourth emperor of the Jurchen Dynasty, introduced a formalized system of bank-issued notes, known as Jiaochao. This initiative was designed to streamline commerce and reduce the risks associated with carrying precious metals over long distances.

At the time, Chinese merchants were involved in extensive regional and cross-border trade. Traditionally, they carried large amounts of gold or silver with them, which was both inconvenient and dangerous. Robbery, loss, and transport limitations were constant concerns. To address this, Wanyan Liang’s administration established a network of official institutions where merchants could deposit their gold and receive a paper note in return — a written proof of deposit backed by the government.

These paper notes functioned like early banknotes. When a merchant arrived in a different city, he could present the note at a corresponding institution and redeem it for goods or an equivalent value in local currency. This system eliminated the need to carry physical gold, reduced transaction risk, and made trade significantly more efficient.

What made this especially revolutionary was that the Jiaochao system was formal, standardized, and backed by the state — unlike earlier informal note systems based solely on trust between individual traders. It laid the groundwork for a more secure, scalable, and centralized financial infrastructure, capable of supporting China’s growing economic complexity.

Historians often regard this development as far ahead of its time. While Europe was still heavily reliant on coin-based trade, China was pioneering a monetary innovation that would not reach the West for centuries. Wanyan Liang’s introduction of paper money marked one of the earliest examples of government-regulated currency, foreshadowing the systems used by modern central banks today.

The Spread of Paper Currency to Europe

Marco Polo’s Observations and the Rise of National Currencies

By the 13th century, the innovation of paper money in China had caught the attention of the outside world — particularly through the eyes of a curious European traveler. Marco Polo, the famous Venetian explorer, journeyed to China and spent years at the court of Kublai Khan. During his travels, he closely observed the Chinese financial system, especially the use of government-issued paper currency — a concept entirely foreign to Europe at the time.

Fascinated by this sophisticated monetary innovation, Marco Polo documented in great detail how the Chinese issued paper notes, backed by the state and trusted across vast distances for trade. When he returned to Europe, his accounts created a ripple effect among European merchants and rulers. Inspired by the Chinese model, European nations began developing their own forms of paper currency to simplify trade within their territories.

In England, this evolution gave birth to the Pound Sterling, a currency that originally represented a fixed amount of gold — precisely 7.3 grams per one pound sterling. Similar systems emerged across Europe, each backed by a tangible value in silver or gold, bringing a new level of efficiency and reliability to domestic trade.

National Currencies Enable Local Trade

But Pose Global Challenges

As each nation adopted its own paper currency, domestic commerce became easier and more structured. Traders could now engage in transactions using a trusted, standardized medium of exchange, backed by the government and redeemable in precious metals. However, a new challenge soon became apparent — international trade.

While internal trade had become more efficient, cross-border transactions were chaotic and uncoordinated. Since every country used its own currency — such as China with the Yuan, England with the Pound Sterling, and others with their respective national currencies — international trade required a cumbersome process of currency exchange and valuation.

For example, when a Chinese merchant wanted to purchase goods from Europe, he would offer payment in Yuan. The European seller, however, preferred to receive Pounds or another local currency. This mismatch led to a system where currencies were converted back into gold, the universal standard, to ensure fair value. Gold became the common reference point in international trade, enabling countries with different currencies to transact with each other through a gold-convertibility mechanism.

Gold as the Anchor of Global Trade

The Limits of Currency and the Power of Reserves

As international trade expanded, a deeper economic truth began to emerge: having a national currency was not enough to participate meaningfully in global trade. What mattered most was how much gold a country possessed — because under the gold standard system that gradually took shape, paper currency could only be printed in proportion to a nation’s gold reserves.

In simple terms, if a country wanted to import goods from abroad, it needed to have enough gold to back the currency it would use to pay for those imports. Every unit of paper money was tied to a specific quantity of gold. This gold-convertibility mechanism acted as a natural check — no country could print unlimited money. The more gold a nation held, the more currency it could issue, and the more it could trade on the global stage.

This created a direct link between gold, production, and national power. The countries that produced and exported more goods and services accumulated more foreign currency, which they could then convert into gold. That gold added to their reserves, giving them the ability to issue more of their own currency — creating a virtuous economic cycle of growth, trade, and monetary strength.

By the early 19th century, the center of global trade had firmly shifted toward Britain. With the onset of the Industrial Revolution, the United Kingdom became the world’s leading producer of goods, supplying textiles, machinery, and manufactured products to nearly every continent. British merchants and companies exported their goods across Europe, Asia, Africa, and the Americas, establishing a global trade network unrivaled in its scope and reach.

As Britain’s exports flourished, foreign countries began to pay in British Pounds, which were redeemable in gold under the gold standard. Over time, Britain accumulated large reserves of gold, reinforcing the strength of the Pound Sterling. At the same time, other countries began to hold Pounds instead of physical gold — because the British currency was stable, backed by gold, and accepted virtually everywhere.

This marked the first time in modern history that a national currency was used as a global reserve. The Pound Sterling became a symbol of international trust, and London emerged as the world’s leading financial center. Foreign central banks, governments, and merchants preferred to hold reserves in Pounds, making it the default currency for international transactions and long-term savings.

By the late 1800s, Britain’s financial and industrial empire was unmatched. The phrase “Sterling area” referred to the group of countries that used or pegged their currencies to the British Pound — effectively creating a financial bloc with London at its heart.

But this dominance wouldn’t last forever.

Why the US Dollar Is the Global Currency

A New Contender Emerges

The Rise of the United States and the Dollar

As the 20th century approached, the United States — once a young and isolated nation — began transforming into a major industrial power. Fueled by vast natural resources, innovation, and a growing domestic market, America’s economic engine started to rival that of Britain. By the early 1900s, the U.S. had become the world’s largest economy in terms of industrial output.

However, international finance was still dominated by Britain, and the Pound Sterling remained the global reserve. That began to change in the lead-up to World War I.

In 1913, a pivotal year, the United States took a historic step by establishing the Federal Reserve System — its first true central bank. This gave the U.S. government greater control over its currency and monetary policy, laying the institutional foundation needed to support a global role for the US Dollar.

When World War I broke out in 1914, the financial landscape began to shift dramatically. Britain and other European powers had to finance massive war expenditures, which led them to abandon the gold standard temporarily and print more money. Their economies were strained, their currencies weakened, and their gold reserves depleted.

The United States, meanwhile, remained neutral for most of the war and continued trading with both sides. As European economies faltered, foreign nations turned to the U.S. for loans, goods, and raw materials. Payments were increasingly made in gold, causing American gold reserves to soar. By the end of the war, the U.S. held more than half of the world’s gold supply, giving it unmatched monetary strength.

The Turning Point: From Sterling to the Dollar

By the time World War I ended in 1918, the balance of power had clearly shifted. Britain was heavily in debt, its industrial output had declined, and the Pound was no longer seen as infallible. Meanwhile, the U.S. emerged as the world’s largest creditor nation, with a booming economy and a currency backed by massive gold reserves.

Though the Pound Sterling remained influential in the 1920s, the writing was on the wall: a new financial superpower was rising. The US Dollar, once a domestic currency with limited global use, had now become a trusted international medium of exchange, backed by strong institutions, economic productivity, and gold.

This transition set the stage for the complete restructuring of the global financial system after World War II, when the U.S. would finally solidify its dominance — and the Dollar would permanently replace the Pound as the world’s primary reserve currency.

Bretton Woods 1944

Building a New Financial World to Avoid Economic Collapse

As World War II approached its final stages in 1944, the global economy stood on the edge of collapse. Most of Europe lay in ruins, supply chains were shattered, currencies were unstable, and trust in the international financial system was rapidly eroding.

There was a genuine fear among economists and world leaders that, if action wasn’t taken, the global economy could fall back into chaos — even reverting to the barter system, where countries exchanged goods directly in the absence of trusted currencies. The Great Depression of the 1930s and the trade wars that followed had already shown how dangerous an uncoordinated financial system could be.

To avoid repeating the mistakes of the past, 44 Allied nations gathered in Bretton Woods, New Hampshire (USA) in July 1944 to establish a new global economic order. The goal: to design a stable and reliable international monetary system that would support reconstruction, global trade, and long-term peace.

Why the US Dollar Became the Backbone of the New System

At Bretton Woods, the United States was in a unique position of power. It had

- The world’s strongest economy,

- The largest industrial output,

- And more than two-thirds of the world’s gold reserves.

These facts made the US Dollar the most trusted and stable currency available. So, rather than go back to a gold-only system, the Bretton Woods delegates agreed on a new model

- The US Dollar would be pegged to gold at a fixed rate of $35 per ounce.

- Other countries would peg their currencies to the Dollar.

- This meant that instead of every nation hoarding gold, they could hold US Dollars as reserves, confident that it was convertible to gold.

In short, the Dollar became the anchor of the new global financial system.

Read Also : What is E-Commerce

Creation of the IMF and World Bank

A New Global Financial Infrastructure

To support this new system, two key institutions were established at Bretton Woods

The International Monetary Fund (IMF)

The IMF was created to provide short-term financial assistance to countries facing balance-of-payments problems — essentially, to prevent currency collapses and restore economic stability when nations struggled.

The World Bank

The World Bank was designed to offer long-term loans for reconstruction and development, particularly in war-torn regions of Europe and Asia.

Together, these institutions ensured that nations could rebuild their economies without falling back into protectionism, devaluation, or isolation — all of which had fueled previous global conflicts.

The Dollar’s Role in Post-War Reconstruction

“Buy from Us, Rebuild Yourselves”

After the war, the U.S. offered financial aid to countries — but with a clear strategic advantage. Nations in need of rebuilding were told:

“You have access to dollars, and you have the IMF and World Bank to provide loans. Use those dollars to buy American goods, machines, and resources to rebuild your economies.”

This created a self-reinforcing system

- Countries borrowed in dollars,

- Traded in dollars,

- And saved in dollars.

The US economy flourished, exporting goods and capital while simultaneously shaping the global economy in its image.

This wasn’t just financial aid — it was geopolitical strategy. By anchoring global trade and reconstruction to the Dollar, the U.S. ensured that its currency, companies, and influence would dominate the post-war world.

Oil Enters the Picture: The Most Strategic Commodity on Earth

While this new Dollar-based system was taking shape, another global shift was quietly unfolding: the rise of oil as the world’s most essential resource.

By the mid-20th century, oil had replaced coal as the fuel that powered

- Industries,

- Transportation (cars, planes, ships),

- And entire militaries.

Oil was no longer just a commodity — it became a strategic asset, crucial to every nation’s economic survival and defense.

Western Oil Companies Controlled the Oil Supply Chain

At that time, the majority of oil exploration, extraction, and refining was controlled by Western companies — mostly American and British giants like

- Standard Oil (now ExxonMobil and Chevron),

- Shell,

- BP (British Petroleum),

- Texaco, and others.

These companies operated in oil-rich regions — particularly in the Middle East, where Arab countries like Saudi Arabia, Kuwait, Iraq, and Iran had vast reserves but lacked the technology, infrastructure, and market access to exploit them.

In fact, many Arab nations didn’t even know where all their oil was, let alone how to extract or refine it. They depended entirely on foreign expertise and equipment.

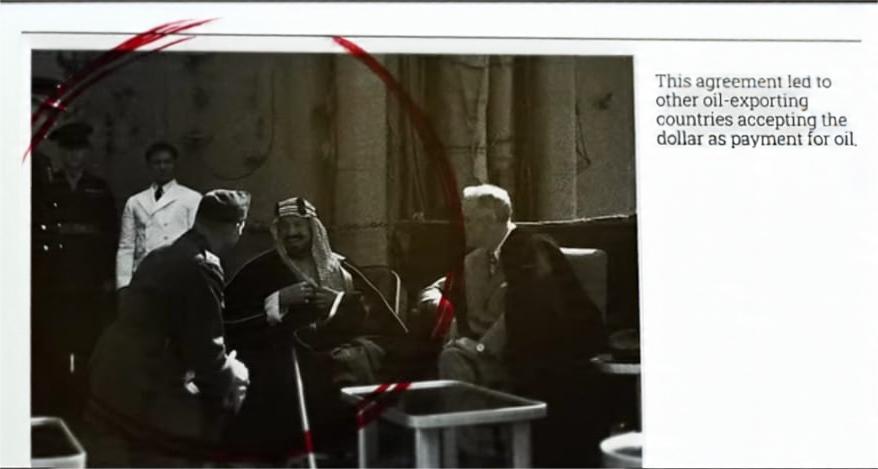

The U.S.–Saudi Deal of 1945: Oil for Protection, Dollars for Oil

One of the most consequential moments in this strategy occurred in 1945, just as World War II was ending.

U.S. President Franklin D. Roosevelt met with King Abdulaziz of Saudi Arabia aboard the USS Quincy in the Suez Canal.

This meeting resulted in a historic and unwritten agreement that changed the world

- The United States would provide military protection, weapons, and political support to the Saudi monarchy.

- In return, Saudi Arabia would give American companies privileged access to its oil reserves.

- And most importantly — all oil sales would be conducted in US Dollars.

This was the beginning of what would later be called the Petrodollar system.

At the time, this seemed like a practical exchange. But in reality, it was a masterstroke of economic and geopolitical strategy. It ensured that

- The most vital resource on the planet would be traded exclusively in one currency.

- And that currency would be issued, regulated, and controlled by the United States.

The Consequence: The World Needs Dollars to Survive

As other Arab nations adopted similar Dollar-based oil trade agreements, a new global financial reality emerged

- If any country wanted oil, it had to first acquire US Dollars.

- Whether you were Germany, Japan, Brazil, or India — you couldn’t buy oil in your local currency.

- You had to earn or borrow Dollars, and then use them to pay for oil.

This created an artificial, permanent demand for the US Dollar — regardless of whether the buyer had any connection to the US economy itself.

Even countries that had political differences with the United States had no choice but to hold large Dollar reserves, because that was the only way to keep their economies running.

The US Dollar was now tied directly to oil, the world’s most indispensable resource — giving it a level of power and global relevance no currency had ever achieved before.

Why No Country Could Challenge the Dollar

A Web of Power Beyond Currency

By the time the Petrodollar system was fully in place during the 1970s and 1980s, it became clear to the world:

Challenging the Dollar wasn’t just an economic decision

it was a geopolitical risk.

Almost every country, whether an ally or a rival of the United States, understood this reality. They may have grumbled about Dollar dominance, but they didn’t have the means — or the courage — to escape it.

Why the US Dollar Is the Global Currency

Here’s why

1. The US Became a Multi-Dimensional Superpower

After World War II and through the Cold War era, the United States didn’t just dominate financially. It led the world in almost every critical domain

- Economic Power: The US had the largest economy, controlling more than 25% of global GDP.

- Military Power: With a vast network of military bases around the world, unmatched naval presence, and the largest nuclear arsenal, military deterrence became a real factor.

- Technological Power: The U.S. controlled most of the world’s communication networks, satellites, semiconductors, and IT infrastructure.

- Cultural Power: Through Hollywood, media, brands, and universities, America shaped the world’s narrative.

- Institutional Power: Global institutions like the World Bank, IMF, United Nations, and even credit rating agencies operated under strong American influence.

This wasn’t just about controlling currency — the Dollar was backed by the entire architecture of American supremacy.

2. The Global Financial Plumbing: From Telex to SWIFT

In the early days of international banking, TELEX was used for sending cross-border transaction instructions between banks. But by the 1970s, it was replaced by a far more efficient and standardized system

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) Network, founded in 1973.

- Headquartered in Belgium, but with strong US operational oversight, SWIFT became the backbone of international bank-to-bank communication.

- It allows banks in more than 200 countries to securely and instantly send payment instructions across borders.

- Nearly every bank that does international business is connected to SWIFT.

So, while SWIFT is technically neutral and European, the US Dollar’s centrality to the global economy gives the United States de facto control over global transactions — because most international trade passes through US-linked correspondent banks.

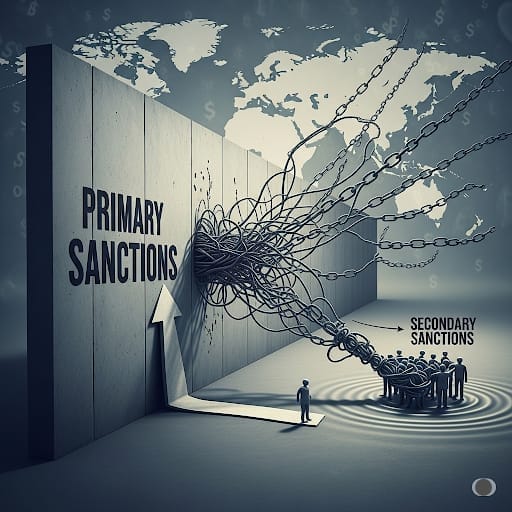

3. Sanctions as a Weapon: Primary and Secondary

Once this control over global finance was established, the United States developed a powerful non-military tool to enforce its interests: economic sanctions.

There are two main types

➤ Primary Sanctions

These apply to US persons or companies. For example, American firms are banned from doing business with sanctioned countries like Iran, North Korea, or Venezuela.

➤ Secondary Sanctions

This is where it gets more serious.

Even non-US companies can be punished if they do business with US-sanctioned entities.

For example:

If a German, Chinese, or Indian company sells goods to Iran and uses Dollars for payment (or touches the US banking system in any way), the US can block that company from accessing the US market or fine their banks.

This sends a very clear message:

“If you want to stay in the global system, you play by Dollar rules.”

4. Dollar Invoicing and Clearing Dominate Global Trade

More than 80% of global trade — including non-US transactions — is invoiced in Dollars, even if the buyer and seller are not American.

For example

- A Japanese company buying oil from Saudi Arabia often pays in US Dollars.

- A Brazilian company selling soybeans to China? Also usually settled in Dollars.

These trades often pass through US correspondent banks — meaning the US can monitor, block, or trace transactions anywhere in the world.

This gives the United States unparalleled visibility into global trade flows — and the ability to target any party it deems hostile or risky.

5. Why Most Countries Gave Up Challenging the Dollar

Some countries — like Iraq (under Saddam Hussein), Libya (under Gaddafi), Iran, and Russia — have tried to move away from the Dollar or build alternatives.

- Saddam tried to sell oil in euros — we know how that ended.

- Gaddafi proposed a gold-backed African currency — he was removed from power within months.

- Iran and Russia have pushed for non-Dollar oil trade, but face heavy sanctions and financial isolation.

Even rising powers like China — despite promoting the Yuan and setting up the Cross-Border Interbank Payment System (CIPS) — still settle most of their trade in Dollars.

Why? Because no other currency offers:

- The liquidity of the Dollar,

- The trust of the Dollar,

- Or the depth of global infrastructure built around it.

The Dollar Isn’t Just a Currency — It’s a System of Control

- The US military protects trade routes.

- The US Treasury monitors banking systems.

- The Federal Reserve anchors global credit markets.

- The US Dollar is the key to SWIFT, international loans, and global reserves.

- And sanctions make sure no one steps too far out of line.

It’s not just economic dominance — it’s strategic entrenchment. The Dollar doesn’t just move money. It moves power.

Read Also : How to invest in India’s Top Trends

“The Future of Global Currency

A Moment of Uncertainty and Transformation

I really loved how you used such eye-catching and attention-grabbing images in this article on the US dollar as the global currency. The visuals make the complex topic of international trade, global finance, and currency dominance so much more engaging and reader-friendly. Truly a great balance of insightful content and impactful presentation!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.